What Makes Ethereum the Future of Finance? Find Out How It Works with Forbes Advisor!

Understanding Ethereum’s Role in the Future of Finance

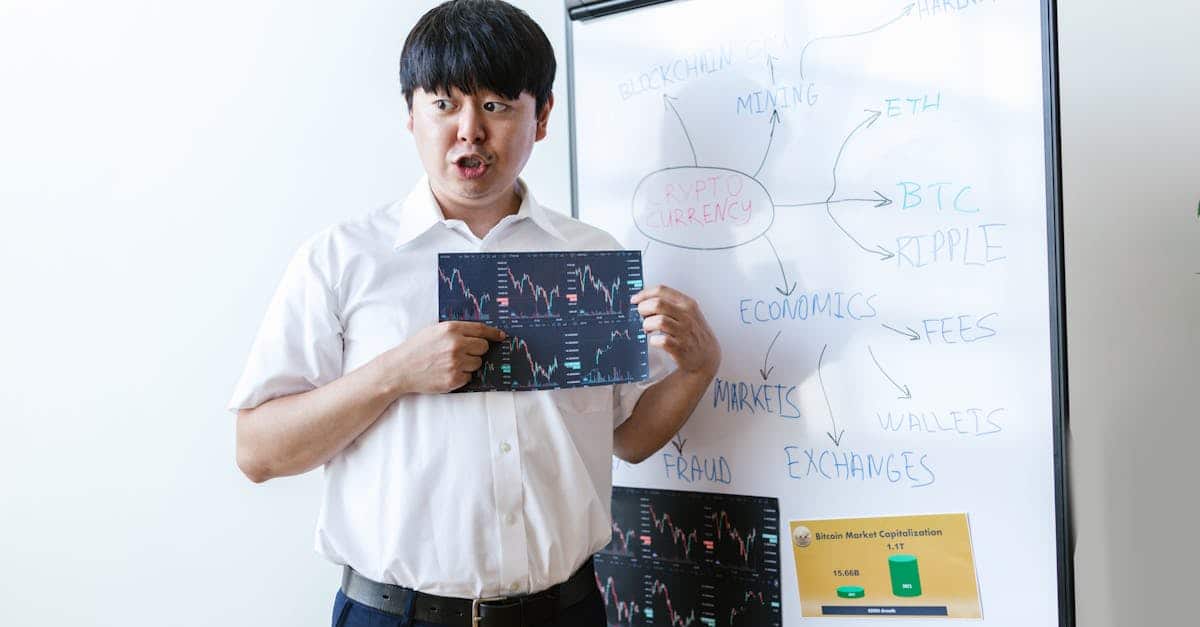

In the ever-evolving landscape of cryptocurrencies, Ethereum stands out as a unique and multifaceted platform that goes beyond the traditional boundaries established by its predecessors. Launched by the innovative minds of Vitalik Buterin and Gavin Wood in 2015, Ethereum has secured its position as a major contender in the crypto space, accounting for roughly 20% of the total $1.1 trillion crypto market value.

Unlike Bitcoin, which is primarily seen as a means of payment or an investment, Ethereum’s scope is far more encompassing. It operates as a decentralized computing network built upon the solid foundation of blockchain technology.

Ethereal Innovations: Beyond Just Currency

Ethereum presents itself as a metamorphic layer of blockchain, enabling a myriad of applications from games to comprehensive financial platforms to operate securely and efficiently on its foundation. As a testament to its versatility, several other cryptocurrencies also utilize its infrastructure.

At the core of Ethereum is its pioneering blockchain network—a secure and decentralized public ledger keeping every transaction transparent and immutable. This network empowers every participant with a consistent copy of the ledger, ensuring equal visibility of historical transactions without the control of a centralized party.

Distinguishing Ether from Ethereum

While Ether functions within its realm as a digital currency akin to Bitcoin, facilitating trade and serving as an investment and value reserve, Ethereum is the expansive blockchain ecosystem underpining Ether and enabling a broad spectrum of additional capabilities.

Ethereum users can create decentralized applications (dApps) that exist and operate on the blockchain as effortlessly as traditional software runs on a computer. These dApps can manage intricate tasks, such as transferring and safeguarding personal data, or facilitating complex financial transactions.

Ethereum Versus Bitcoin: A Comparative Analysis

While Ethereum shares similarities with Bitcoin, acting as a virtual currency and a value store, it has distinct features that set it apart. Ethereum not only supports currency transactions but also allows for the deployment of dApps, execution of smart contracts, and other complex operations on its network—a flexibility Bitcoin does not currently offer.

Moreover, Ethereum is ahead in terms of transaction efficiency with blocks verified approximately every 12 seconds, in comparison to Bitcoin’s 10-minute block confirmation time. Anticipated advancements are expected to further enhance Ethereum’s transaction speeds.

The unlimited potential supply of Ether contrasts with Bitcoin’s 21 million coin cap, creating different economic implications for each digital currency.

The Advantages and Challenges of Ethereum

Ethereum’s strengths lie in its established and robust network, which has stood the test of time, facilitating billions in value exchange. It boasts a vast and fervent global community, with the most extensive ecosystem in the realm of blockchain and cryptocurrency.

However, rising transaction fees, known as “gas,” present a significant challenge due to increasing demand. The absence of a maximum coin limit raises concerns over potential inflationary effects, and developers face a steep learning curve when transitioning to decentralized networks.

The Evolution to Ethereum 2.0

The pivotal shift to Ethereum 2.0 transitioned the network from proof-of-work to proof-of-stake consensus mechanism, dramatically reducing the environmental impact by eliminating energy-intensive mining operations.

Acquiring Ether – A Step-by-Step Guide

It is important to understand that one does not purchase the Ethereum network itself, but rather Ether, the cryptocurrency that powers it. Here’s how to go about it:

- Select a cryptocurrency exchange.

- Deposit traditional currency.

- Exchange your funds for Ether.

- Store Ether securely in a wallet.

To Buy or Not to Buy Ether?

Potential investors might find appeal in Ethereum for its dual function as a currency and a foundation for novel applications. As the Ethereum blockchain gains more users, demand for Ether could increase.

While Ether poses as an attractive asset, it’s advisable for potential investors to consult with financial advisors and to only invest funds they are prepared to risk, due to the volatile nature of the market.

The information provided here does not constitute investment advice but serves an educational purpose. Those looking to participate in the Ethereum market should conduct due diligence and proceed with caution.